🚌 Estimating & Rehab Bus Tour: A Hands-On Journey Through Dayton Real Estate

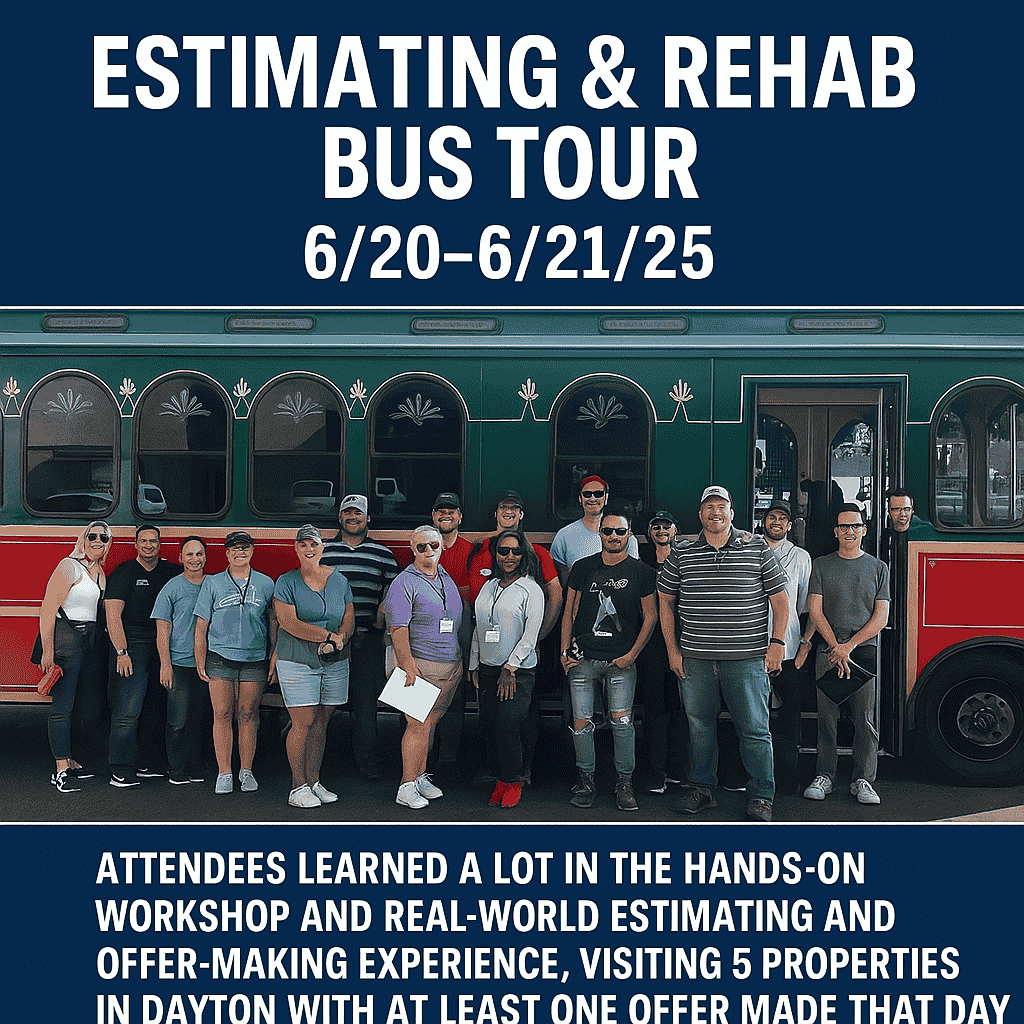

On June 20th and 21st, 2025, a vibrant green-and-red bus rolled through the streets of Dayton, Ohio—not as a sightseeing tour, but as a mobile classroom for aspiring and seasoned real estate investors. The “Estimating & Rehab Bus Tour” brought together a dynamic group of attendees for an immersive, hands-on experience in property evaluation and offer-making.

🔍 What Made This Tour Unique?

Unlike traditional seminars confined to hotel conference rooms, this tour took learning to the streets. Participants visited five real properties across Dayton, each offering a unique set of challenges and opportunities. With boots on the ground, they practiced:

- Estimating rehab costs with real-world examples

- Evaluating property potential based on location, condition, and market trends

- Making offers—with at least one offer submitted during the tour!

🛠️ Learning by Doing

The heart of the event was its workshop-style approach. Attendees didn’t just listen—they measured, calculated, and strategized. Guided by experienced investors and rehab specialists, they learned how to:

- Spot hidden costs and structural issues

- Prioritize renovations for ROI

- Use tools and templates for accurate cost estimation

- Navigate the offer process with confidence

🤝 Building Community

Beyond the technical skills, the tour fostered connections. Participants shared insigh ... Read More…