Indulge me in a fable, and see if it jibes with your current, or perhaps past, experience as a developing real estate entrepreneur:

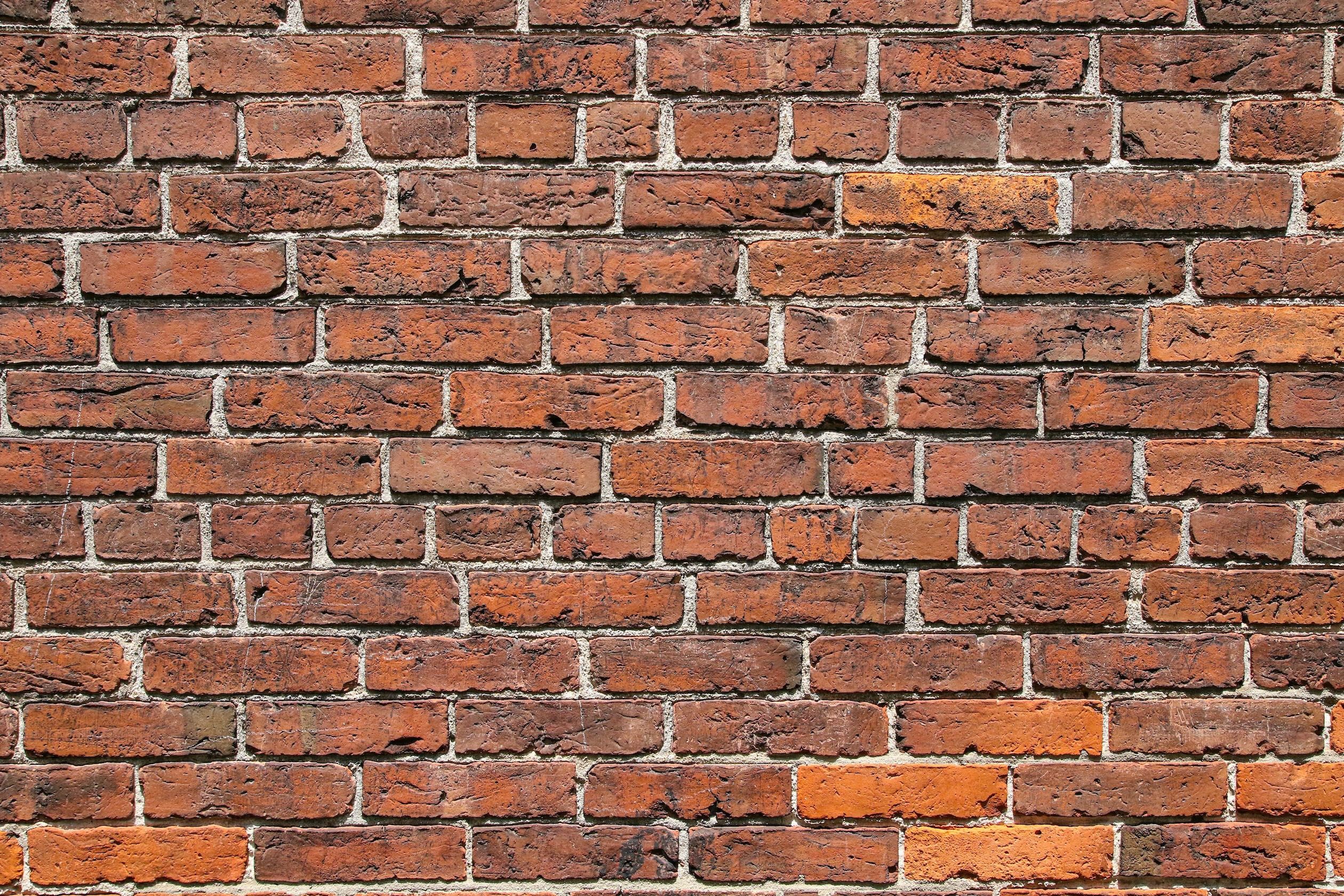

You’re standing on a sidewalk with your nose an inch away from a brick. It’s a good brick. You’ve studied it for a while, and you’ve come to the conclusion that it’s reddish, rough, and surrounded on all four sides by parts of other bricks. You’ve looked at it long enough to decide that it’s a pretty great brick.

Someone walks by and asks, what are you doing? Looking at this brick, you reply.

Are you sure it’s a brick you’re looking at? the stranger queries. You might want to take a step back, because there’s more to see here than you think.

So, you take a step back, and you realize that he’s right: the brick you’ve been so obsessed with is just one of many. In fact, from your new perspective, you notice out of the corner of your eye that there’s also something else--a hole, with glass and wood in it. I

Read More...